Everything Your Tax Resolution Practice Needs to Succeed

Tax resolution is easier and more profitable with IRS Solutions®

- Optimized solution recommendations

- Proactive transcript monitoring

- Automated IRS activity and transcript update alerts

- Access to expert support

Tax Resolution Software

Earn more, work less with IRS Solutions.

Bulk Transcript Download with Instant Analysis

Access, download, and print all of your client transcripts with the ultra-fast IRS Solutions® transcript retrieval tool. Pull multiple years and clients in seconds, then get to work with comprehensive, easy-to-read reports.

Automatic Audit Alerts and Weekly Transcript Download

The system will log into e-Services and you will be notified of possible pending audits, solution acceptance or rejection, acknowledgement of CAF approval, or changes to passport status. Receive weekly email notifications of client transcript changes.

Bankruptcy Tax Discharge Date Calculator

Determine if and when taxes may be discharged in bankruptcy.

Power of Attorney & Tax Information Authorization

Save time with forms auto-populated for client signature and direct CAF upload. You’ll receive an email as soon as the CAF unit has approved your request.

Full Tax Analysis Reports

Generate fully customizable, comprehensive, and detailed client reports. Share information about:

- Income and Expenses

- Tax owed

- Collection alternatives

- and more

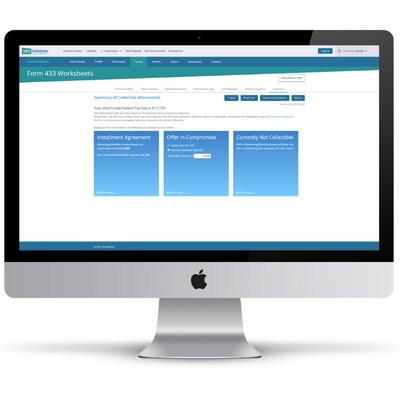

Collection Alternatives

The system will analyze your client’s data and the IRS transcript to recommend the solution most likely to be accepted by the IRS:

- Installment Agreement

- Offer In Compromise

- Currently Not Collectible

Tax Resolution Management FAQs

Using the IRS Notice Advisor Tool is simple. All you have to do is enter your client’s notice number and the system will provide you with a sample copy to review. You’ll also receive step by step instructions to help your client and templated letters you can use to respond.

The intelligent IRS Solutions OIC calculator has been trained to follow the rules of the Internal Revenue Manual. It analyzes the data you input to create a quick representation of the most likely outcome.

Yes, whether you are helping an individual or business client, you can easily access the Form 433 and 656 series from within the IRS Solutions platform.

All of the letters and templates built into the IRS Solutions system are automatically populated with your logo and firm information. You can edit, and customize them and can save your favorite templates.

Using the data that the client has already supplied, you can toggle between Form 433-A, Form 433-A (OIC) or even Form 433-F without having to re-enter any data.

The intelligent IRS Solutions software will help you determine whether Offer in Compromise (OIC), Installment Agreement (IA) or Currently Not Collectible (CNC) is optimal in each case and present the best option to your client.

All the forms that you might need for IRS collection and audit issues are included with your IRS Solutions membership, and it couldn’t be easier to use them. The software will let you know which form you need and ask you some easy-to-answer input questions. All you have to do is follow the instructions.

IRS reports can be hard to understand and what you need to find can be difficult. IRS Solutions simplifies and streamlines the process giving you exactly the data you need and the easy-to-read reports you can give to your client.

Links can be found throughout the software to bring you directly to the most current changes in the IRM.

What Do Tax Pros Say About IRS Solutions®?

Tax resolution specialists, CPAs, Enrolled Agents, accounting professionals, attorneys

and even ex-IRS agents all praise IRS Solutions.

Try IRS Solutions® 100% Risk-Free

Let us show you how IRS Solutions can transform your tax practice.

The Only Platform Built by Tax Pros for Tax Pros

IRS Solutions team members personally manage numerous real-life resolution cases every year. This keeps us current on tax laws and constantly-changing IRS regulations to ensure that we always offer the best and most innovative resolution software to meet your needs.

Explore IRS Solutions' Powerful Features

Partnerships and Integrations

We work with the tax industry’s best and have developed a network of partnerships and integrations,

united by a shared commitment to provide cutting-edge resources for tax professionals.