Simple, Transparent Pricing for Tax Resolution & IRS Transcript Monitoring

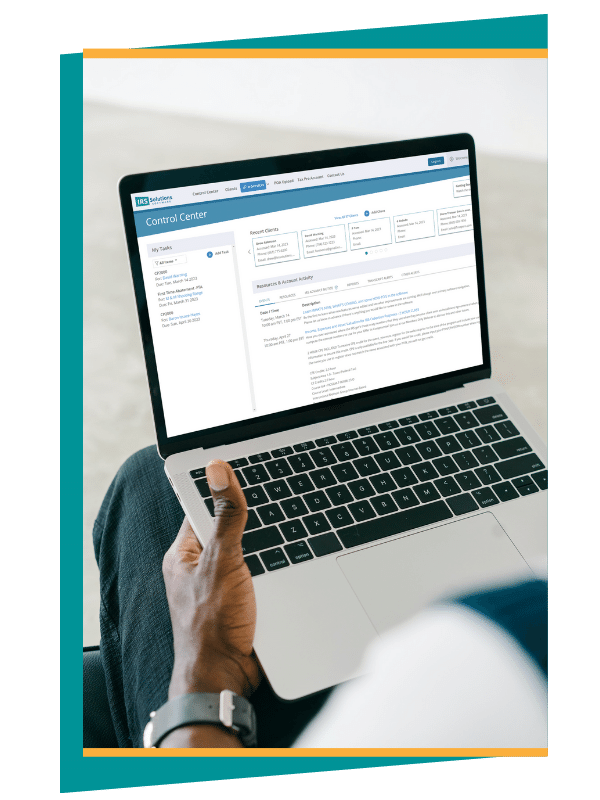

Streamline case management, monitor transcripts proactively, and grow your practice with confidence.

All-in-One IRS Tax Resolution Software With No Hidden Fees

No Contracts. Switch or Cancel* Anytime.

*effective at the end of the billing cycle

Multi-User License

-

Savings scale with your team. For every 2 users, the 3rd is free - automatically included.

- 3 User Monthly $318

- 6 User Monthly $636

- 9 User Monthly $954

- 12 User Monthly $1,272

- 15 User Monthly $1,590

- 18 User Monthly $1,908

- 21 User Monthly $2,226

Multi-User License

-

Built-in savings for teams and annual plans - every 3rd user is free, 12 months for the price of 10.

- 3 User Annually $3,180

- 6 User Annually $6,360

- 9 User Annually $9,540

- 12 User Annually $12,720

- 15 User Annually $15,900

- 18 User Annually $19,080

- 21 User Annually $22,260

Use the entire platform for 60 days – everything we offer, not a pared-down trial version. We are so sure that you’re going to love it that we’ll give you a full refund if you don’t, no questions asked.*

*If you’re not completely satisfied with IRS Solutions during the first 60 days of your annual membership, simply request a refund by contacting our customer support by calling (844) 447-7765 or emailing support@irssolutions.com, and we’ll cancel your membership and refund your subscription charges.

All User Licenses Include:

One Membership Fee Gets You All This and More

- Automatic transcript download

- Detailed transcript analysis, including differences between what was reported to the IRS vs. what was filed on the return

- IRS Advance Notice™, the state-of-the-art way to know about IRS actions

- CSED calculator

- White-labeled dedicated client portal, branded with your logo and custom URL

- No setup fees

- Made-for-you marketing

- Customer service support complete with calendar links for your convenience

- Data security via AWS Government Cloud

- E-signature integration

- User-friendly, easy-to-understand interface

- CPACharge© to manage payment processing

- Customized invoicing

Recognized & Trusted by Tax, Accounting, Financial, and Legal Professionals

IRS Solutions Software is consistently top-rated by professionals and industry experts for its value, functionality, and exceptional member support.

Plans & Billing FAQ

IRS Solutions® offers an all-in-one membership with no hidden fees. Unlike other tax resolution software providers, we include every critical feature you need to succeed—at one affordable price.

Your IRS Solutions membership includes five complimentary e-signature requests to help you get started. E-signatures can be purchased in bulk, with prices ranging from $1 to $2 per signature request, depending on the package.

As tax pros, we know what it takes to provide tax resolution services. You can’t do your job without transcript delivery, reporting, and other similar functions. We don’t charge extra for basic features like these. They’re built into your membership fee.

We’re so confident in the IRS Solutions platform, community, and unrivaled support that we back our product with a money-back guarantee. If you’re not completely satisfied with IRS Solutions during the first 60 days* of your annual membership, simply request a refund by contacting our customer support by calling (844) 447-7765 or emailing support@irssolutions.com, and we’ll cancel your membership and refund your subscription charges.

*Please note that this policy does not apply to renewal memberships. To be eligible, refunds must be requested within the 60-day period. The 60-day money-back guarantee only applies to the member’s first subscription.

A single-user IRS Solutions license supports one login per session. If your practice will require multiple employees to access the platform simultaneously, please consider signing up for a multi-user license.

Offering a free trial often doesn’t convey the full experience and benefits of IRS Solutions, especially considering the complexity and depth of tax resolution work. Therefore, we offer a money-back guarantee within the first 60 days of your membership to provide a risk-free way for you to assess the software’s comprehensive capabilities over a meaningful period. This ensures users have full access to all features, including automatic transcript downloads, client management, and IRS Advance Notice™, granting users a comprehensive experience.

Additionally, if you’re unsure, we encourage booking a 30-minute demo with us. During this session, we’ll guide you through the features and address any questions you have, ensuring you’re well-informed about how our software helps you grow your business.

If you’re not completely satisfied with IRS Solutions during the first 60 days* of your annual membership, simply request a refund by contacting our customer support by calling (844) 447-7765 or emailing support@irssolutions.com, and we’ll cancel your membership and refund your subscription charges. *Please note that this policy does not apply to renewal memberships. To be eligible, refunds must be requested within the 60-day period. The 60-day money-back guarantee only applies to the member’s first subscription.

Your IRS Solutions membership includes five complimentary e-signature requests to help you get started.

E-signatures can be purchased in bulk, with prices ranging from $1 to $2 per signature request, depending on the package.

We do not charge additional – we want you to use the software. We are always available for quick onboarding training sessions, troubleshooting assistance, and more. We host monthly webinars with our members to walk them through features, capabilities, and best practices.

IRS Solutions is unique in offering automatic transcript downloads that occur in seconds. There are automated monitoring capabilities, and the type of alerts you receive about transcript changes can also be customized.

You can call us at (844) 447-7765, put time on our calendar for a live demo, or watch this on-demand demo that will give you insights into how the software works.

Partnerships and Integrations

We work with the tax industry’s best and have developed a network of partnerships and integrations,

united by a shared commitment to provide cutting-edge resources for tax professionals.

What Our Customers Say About Us

It's easy to see why tax professionals choose IRS Solutions!

Try IRS Solutions® 100% Risk-Free

Let us show you how IRS Solutions can transform your tax practice.