Seamless Invoicing for Tax Pros

- Operate completely within the system

- Brand and customize your invoices

- Record and apply payments against invoices

- Integrate with CPACharge© to process credit card payments

Manage Your Accounts

Streamlined Billing and Receiving

Payments

Electronic invoices and statements. Record payments and track balances.

Invoicing

Create client invoices. Quickly populate with over 20 default line item charges or customize your own.

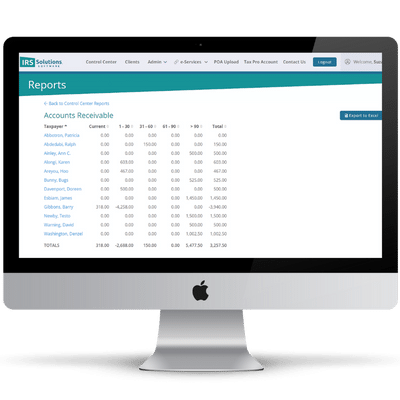

Reporting

Payment, deposit reports, and key business insights are all on the dashboard. Using CPACharge©, you receive notifications via email when a payment is received. Get a detailed aging report to help you stay on track.

Invoicing and Payments FAQs

Client invoicing is included with your subscription. You’ll even have over 20 item templates to choose from, or you can add your own.

IRS Solutions has partnered with CPACharge© to offer you the ability to take payments directly from your clients using their credit card or an eCheck.

Yes, you have access to payment, deposit reports, and detailed aging.

Yes, you can manually enter checks, cash, etc. and post the payment to the appropriate invoice.

IRS Solutions will allow you to input the retainer and then later apply it to appropriate invoice.

If you are using CPACharge© , you’ll be notified both in the application as well as an email if you wish.

What Do Tax Pros Say About IRS Solutions®?

Tax resolution specialists, CPAs, Enrolled Agents, accounting professionals, attorneys

and even ex-IRS agents all praise IRS Solutions.

Try IRS Solutions® 100% Risk-Free

Let us show you how IRS Solutions can transform your tax practice.

The Only Platform Built by Tax Pros for Tax Pros

IRS Solutions team members personally manage numerous real-life resolution cases every year. This keeps us current on tax laws and constantly-changing IRS regulations to ensure that we always offer the best and most innovative resolution software to meet your needs.

Explore Other Powerful Features

Partnerships and Integrations

We work with the tax industry’s best and have developed a network of partnerships and integrations,

united by a shared commitment to provide cutting-edge resources for tax professionals.