Understanding the Difference Between a Levy and a Lien

Knowing the difference between a levy and a lien helps CPAs, Enrolled Agents, and other tax pros guide their clients

Knowing the difference between a levy and a lien helps CPAs, Enrolled Agents, and other tax pros guide their clients

In-depth analysis of wage and income transcripts is a critical skill for every tax resolution accountant and anyone preparing taxes.

The Centralized Authorization File (CAF number) is a database that the Internal Revenue Service uses to manage information regarding professionals

With several products competing for your business, how do you know which offers the best service at the best price?

For CPAs, tax professionals, and enrolled agents, staying up-to-date with the latest IRS correspondence is essential for providing the best possible service to clients. One

As the end of the year approaches, it’s time for CPAs, tax professionals, and enrolled agents to gear up and prepare for tax season, which

In today’s fast-paced and competitive business environment, providing exceptional customer service is crucial for CPAs, tax professionals, and enrolled agents looking to retain and grow

As tax professionals, we often encounter clients who struggle with procrastination, leaving their tax filing responsibilities until the very last minute. While this can create

Helping clients gear up for tax preparation not only makes things easier on them, but also makes things go smoother on your end. The process

As a CPA, tax professional, or enrolled agent, understanding the different types of tax liens is crucial when assisting clients with tax resolution matters. In

For those who were around for it the Tax Reform Act 1986, it’s hard to believe it’s been 30 years. Passed by Congress and enacted

As tax preparers, we understand the importance of managing client relationships in between appointments. If we’re also handling monthly accounting, we see our clients more

Tax resolution services are becoming increasingly more important. Tax preparation is a saturated market. Just look at the classified section of any newspaper during pre-tax

IRS Software saves tax professionals time and hassle when dealing with the IRS. Offer in compromise forms are complicated and require specific knowledge to fill

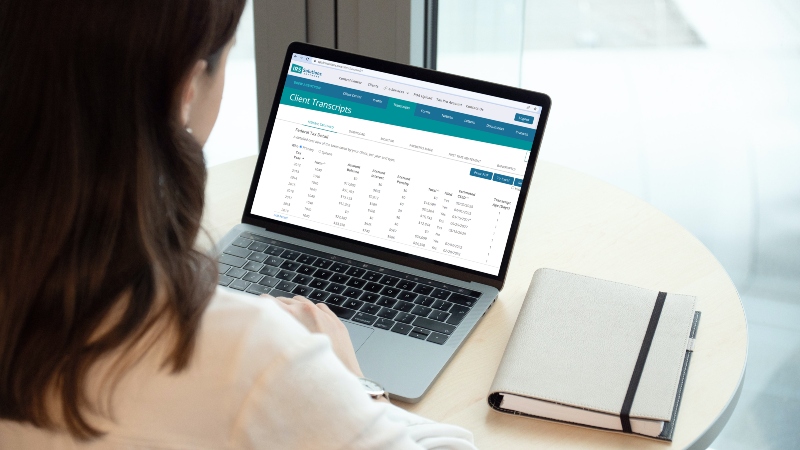

As a CPA, tax professional, or enrolled agent, efficiently addressing your clients’ tax concerns is a top priority. That’s where IRS resolution software comes into

Navigating the complexities of tax resolution can be challenging for even the most seasoned CPAs, tax professionals, and enrolled agents. One critical area of expertise

Q. What is the difference between a tax lien and a tax levy? How do I explain lien vs levy to a client? A. Taxpayers

Q: If a taxpayer has paid the balance in full and received a release from the lien, is there a way to get that removed